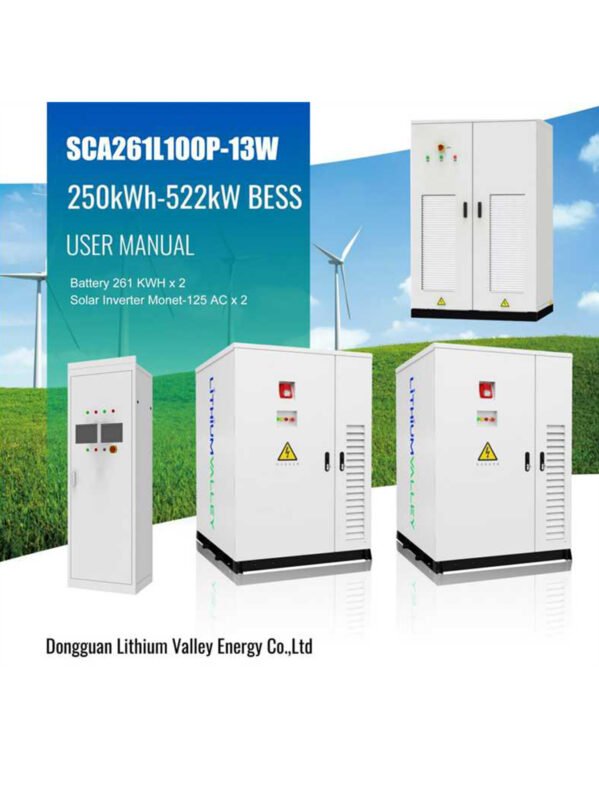

As a cornerstone of the Biden administration’s green agenda, the Inflation Reduction Act (IRA) is driving a monumental shift in the structure of the U.S. energy market. By allocating $369 billion toward renewable energy systems, the act is not only reducing carbon emissions but also fostering innovation in solar power and battery storage, lithium batteries, and power storing technologies. Lithium Valley provides advanced Residential and Commercial Energy Storage Systems for the U.S. clean energy market.

A Financial Framework for a Greener Future

At its core, the IRA integrates climate policy with economic strategy. By increasing corporate taxes and reforming pharmaceutical pricing, it frees up funding for clean energy development. A significant portion of this budget supports solar system projects, lithium iron phosphate batteries, and battery store infrastructure, promoting domestic self-reliance in energy supply chains.

The law’s triad of tools—tax incentives, production credits, and consumer subsidies—restructures America’s clean energy incentives in unprecedented ways. It sets a national target to reduce greenhouse gas emissions by 40% from 2005 levels by 2030, emphasizing critical sectors like solar power with battery storage, electric vehicles, and energy storage systems.

How Tax Incentives Supercharge Solar and Battery Storage

The Investment Tax Credit (ITC) and Production Tax Credit (PTC) have become more attractive than ever. The ITC now covers 30% of the cost of installing solar and battery storage systems, extended until 2034. Standalone solar battery storage solutions, once excluded, now qualify—making them far more accessible to both residential and commercial users.

For projects that meet domestic content standards, the credit increases by another 10%, stimulating local production of key components like lithium ion cells and advanced inverters. Consequently, the U.S. power supply landscape is changing dramatically. From 2020 to 2024, solar module manufacturing capacity in the U.S. grew from 3GW to 28GW.

Reshaping the Battery Market

The IRA’s Section 45X introduces deep subsidies to supercharge U.S.-based battery production. Manufacturers can claim $35 per kWh for producing battery cells and up to $45 per kWh for modules, especially those using cutting-edge lithium battery chemistries such as lithium iron phosphate batteries. These incentives directly reduce the cost of car batteries and energy storage systems, improving affordability for end-users.

Tesla, for example, earned $1.8 billion in production credits from its Nevada Gigafactory in 2023, cutting down Model 3 production costs by $125 per vehicle. But the catch is this: to qualify, companies must perform “substantial transformation” of materials domestically—not just final assembly. This has led to a strategic reconfiguration of the U.S. battery store supply chain.

Smart Regulation and Global Ramifications

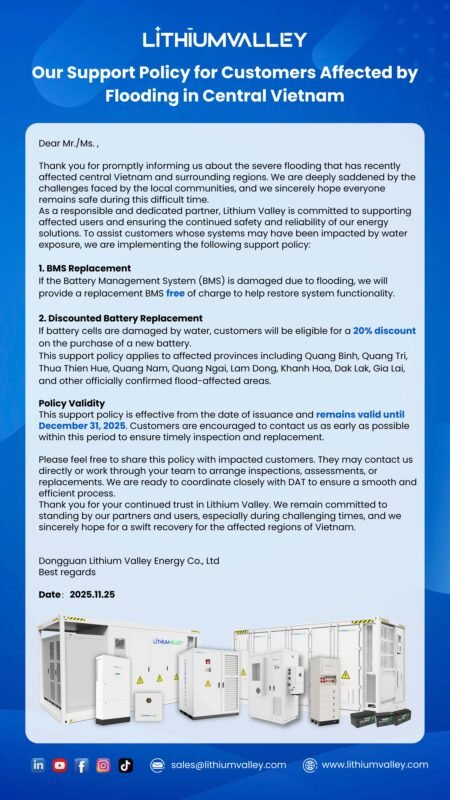

To ensure compliance, the Internal Revenue Service (IRS) has launched the “Energy Credits Online” portal. Yet 23% of applications were denied in 2023 due to incomplete supply chain traceability. The Treasury is now working on a blockchain-powered tracking system to verify the origin of critical materials such as lithium ion compounds and rare earth elements. Lithium Valley also offers Lead-acid Replacement and Power Batteries to support energy resilience initiatives.

The U.S. isn’t operating in a vacuum. Europe has responded with its Net-Zero Industry Act, and countries like Mexico are emerging as alternative production hubs. Chinese solar giants like LONGi and JinkoSolar have shifted operations to Southeast Asia to maintain U.S. market access. Meanwhile, the IRA and its tax provisions are prompting a worldwide race for green manufacturing dominance.

Household Incentives and Consumer Benefits

Perhaps the most noticeable impact is for everyday consumers. The IRA transforms the $7,500 EV tax credit into two components—one based on battery assembly and the other on mineral sourcing. This not only boosts demand for domestically sourced car batteries but also encourages broader investment into solar battery storage solutions.

In 2023, over 750,000 households claimed clean energy credits. Among them, rooftop solar systems with battery storage received average subsidies of $5,084. Used EVs under $25,000 are also eligible for a $4,000 tax credit, further democratizing access to clean technology.

Investment, Innovation, and the Road Ahead

As part of this legislation, the U.S. has committed to a 10-year investment horizon that combines the financial certainty of tax benefits with the flexibility of production subsidies. This ensures that power storing innovations—like Tesla’s lithium clay purification or First Solar’s 22.3% efficient cadmium telluride panels—will continue to evolve.

The IRA also builds resilience into America’s power supply strategy by localizing production and enhancing energy independence. It empowers installers, developers, and suppliers involved in solar power and battery storage to scale operations sustainably, especially those tapping into tax credit programs and contributing to the domestic value chain.

Conclusion: A New Era for Energy Independence and Clean Growth

The Inflation Reduction Act represents more than just a legislative win—it’s a long-term blueprint for decarbonizing America’s energy infrastructure while cultivating innovation in renewable energy systems, lithium batteries, and solar battery storage. With the combined strength of the ITC, PTC, and robust IRS enforcement mechanisms, the act is paving the way for a resilient, low-carbon future.

As global competition heats up and the U.S. doubles down on domestic energy security, companies that align early with these incentives—whether in battery manufacturing, solar project development, or car battery supply—will be best positioned to lead the next wave of global energy transformation.

.png)

.png)

.png)

.png)