Market Overview: Solar and Battery Storage on the Rise

North America’s energy storage industry is rapidly evolving, with solar and battery storage solutions becoming a central pillar in the continent’s shift toward renewable energy systems. By 2024, front-of-the-meter (utility-scale) installations have reached 40 GWh and are forecasted to hit 65–70 GWh in 2025, reflecting a compound annual growth rate (CAGR) of over 60%. This surge is being driven by strong policy support such as the Inflation Reduction Act (IRA), ambitious climate goals, and increasing demands for resilient power supply infrastructure. Lithium Valley offers utility and C&I energy storage systems tailored for North America’s growing power demands.

The market is now structured around three segments: utility-scale storage, residential storage, and commercial & industrial (C&I) storage. States like California and Texas dominate, accounting for over 65% of new installations, making them focal points of storage innovation and investment.

Utility-Scale Storage: Accelerating Supply Power Capabilities

Capacity Growth and Regional Leadership

In 2024, utility-scale storage added 38 GWh, with projections for 2025 reaching 55.9 GWh—up 47.4% year-over-year. California’s preference for 4-hour duration systems positions it as a leader with 19.3 GWh of new capacity expected. In contrast, Texas, which favors short-duration systems (1.7 hours), will account for nearly 32% of national capacity.

More than 60 GW of utility-scale solar power and battery storage projects are in the pipeline across the country. Texas alone is preparing to commission 18.2 GW by 2025.

Incentives and Challenges

Thanks to the IRA, a 30% investment tax credit (ITC) has improved project economics, pushing the internal rate of return (IRR) for standalone storage to 12.8%. Integration needs are also rising as renewable curtailment hit 7.2% in 2024, further highlighting the need for effective power storing solutions.

Regulatory improvements, such as CAISO’s Interconnection Process Enhancements Initiative, have slashed approval timelines by 40%. However, supply chain issues, such as transformer shortages and delivery delays, still affect roughly 15% of projects.

Residential Energy Storage: From Backup Power to Smart Solar System Projects

Innovation and Market Fragmentation

The residential sector hit 8.8 GWh in 2024 and is expected to reach 11.2 GWh in 2025. High-voltage lithium battery adoption is rising, and modular battery storage units now range from 10 to 30 kWh. States like California and Arizona lead in adoption, with over 58% of new installations. Lithium Valley’s Residential Energy Storage Systems are ideal for home backup and solar self-consumption use.

Tesla’s Powerwall maintains a 35% market share, while BYD has grown to 18% due to its local manufacturing in Mexico.

Integrated Solutions and Consumer Incentives

Integrated solar power with battery storage systems now represent 72% of all residential deployments. These systems support up to 10 kW of load—ideal for home appliances and car batteries charging setups.

Policy incentives under the IRA continue to drive growth, offering a 30% tax credit for systems above 3 kWh, encouraging standardization and solar battery storage innovation.

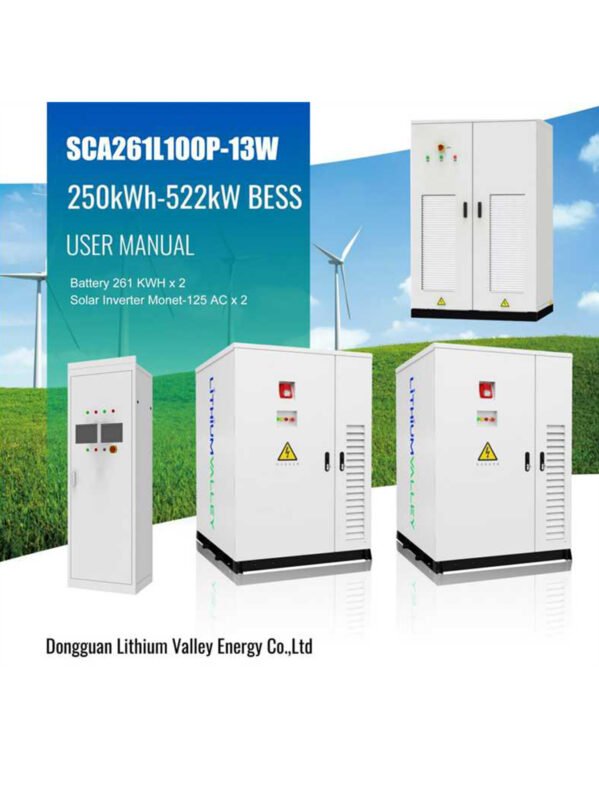

C&I Energy Storage: Cost-Effective Models for High-Load Facilities

Expansion and Payback Improvements

The C&I segment is forecasted to add 16.3 GWh in 2025. California is again the leader, representing 60% of the growth. In regions with high electricity price variances (>$0.35/kWh), payback periods have dropped to just 5.2 years.

New business models, such as community-shared storage and equipment leasing, are helping enterprises achieve IRRs up to 14.7%.

Technology Advancements and Standards

Mainstream deployments now use 200 kWh modular systems with digital twin technologies improving O&M efficiency by 28%. As safety becomes paramount, compliance with UL 9540A thermal runaway tests has become tougher, pushing manufacturers toward safer lithium iron phosphate batteries and next-gen battery chemistries.

Localization and Supply Chain Resilience

The push for domestic manufacturing is central to U.S. energy strategy. The IRA has helped increase localization rates from 32% to 48% in just a year. Tesla’s Megapack leads with a 70% localization rate. Chinese companies are adjusting through joint ventures and regional production:

- CATL is licensing technology to Ford for a 20 GWh facility.

- Gotion High-Tech is building a $2.3B battery plant in Illinois.

- BYD is scaling in Mexico to reduce effective tax rates to 12%.

Technology Race: Lithium, Sodium, and Beyond

Lithium batteries, especially lithium iron phosphate batteries, currently dominate with 90% market share. However, U.S. production costs remain 2.3x higher than in China.

Meanwhile, sodium-ion batteries are gaining traction, expected to reach $0.08/Wh by 2027 and penetrate 30% of sub-4-hour use cases. Solid-state and lithium-metal batteries are also advancing, offering energy densities above 500 Wh/kg—promising breakthroughs for long-duration power storing applications.

Economic Headwinds and Strategic Adjustments

A combined tariff rate of 114.9% has driven up costs dramatically. A containerized system that cost $18,000 in 2023 now exceeds $31,000, slashing IRRs for direct exports to just 5.8%. To adapt, companies are now sourcing materials from Southeast Asia and assembling in Mexico to reduce the effective tax rate to 27%.

Future Outlook and Recommendations

Utility-scale energy storage will continue its rise, surpassing 81.3 GWh by 2026, maintaining a CAGR of 47.3%. Texas will become the fastest-growing state, contributing up to 38% of new capacity by 2028.

Sodium-ion and lithium ion battery technologies will play pivotal roles in diversifying the market. Sub-4-hour systems will lean toward sodium-ion, while long-duration will favor solid-state or lithium-metal technologies.

Conclusion: The Power to Transform Tomorrow

As North America embraces its renewable future, the role of solar and battery storage in creating reliable, clean, and cost-effective power supply solutions cannot be overstated. Backed by transformative policies like the IRA and strengthened by innovations in lithium ion and next-gen chemistries, the continent is on track for a more sustainable grid.

For stakeholders—from developers and manufacturers to residential homeowners—there is no better time to invest in solar system projects, expand into battery store networks, or explore solar power with battery storage as the backbone of a resilient energy economy.

Harness the future. Invest in energy that stores, sustains, and empowers.

.png)

.png)

.png)

.png)